This article provides an overview of the tax-saving benefits pre-sale planning has for business owners in the context of using a Nevada Incomplete Non-Grantor Trust (NING) as part of a business sale. A NING is an irrevocable trust designed to reduce or eliminate potential state income taxes and capital gains taxes upon the sale of a business. Additionally, these trusts offer excellent asset protection for sellers. Generally, NINGs are used by business owners living in high-income-tax states who seek to minimize or eliminate their state income taxes. The NING exists as a form of tax arbitrage to save business owners the cost of state income and federal gift taxes but still permits future asset control by the settlor.

Preliminary planning for the sale of a closely held business

The aim for most entrepreneurs is to develop an exit plan for the sale of their business on their terms. They want to maximize value (or realize their desired value) and close the deal in the most tax-efficient manner[1]. Achieving these outcomes takes planning and forethought well in advance of the sale. Often, I’ve received calls from business owners who’ve rushed to sell their business, skipped over basic due diligence and, consequently, signed documents that end up costing them hundreds of thousands if not millions of dollars in lost profits.

Ideally, business owners should begin the planning process of selling a closely held business a few years prior to the actual sale to maximize the advantage of the NING. A seller’s preliminary due diligence should include consideration as to whether a NING trust will result in post-sale tax savings.

Closely held business owners often lack experience in selecting outside advisors capable of handling the intricacies of the sale of a business. Eager to get to their “number,” many owners hastily engage a business broker or investment banker, who then levies heavy percentage fees for aiding in the sale. I encourage business owners to instead take a step back when selling a closely held business and start with the end in mind. In order to ensure the greatest likelihood of success on the future sale, engaging competent legal and tax professionals with presale planning is critical. This should be done prior to engaging a broker, drafting a letter of intent (LOI), or starting negotiations with a potential buyer.

Structuring the sale of a closely held business in an income tax-efficient manner before signing an LOI can have a massive impact on the amount of cash that ends up in a seller’s pocket. Depending upon whether a business is structured as a C corporation or a “flow-through” entity such as an S corporation, partnership, or limited liability company (LLC), the business owner should become familiar with the impact different tax provisions will have on the sale. These provisions will find their way into the terms and conditions of the negotiated purchase agreement.

For example, early planning may help a company if it is structured as a C-corp, as the owners may be able to take advantage of the “qualified small business stock” (QSB stock) exclusion from gain under section 1202 of the tax code[2] and minimize state income tax. Likewise, preplanning helps prepare the seller if the buyer insists on making an election under IRC 338(h)(10)[3] to treat a stock acquisition as an asset sale. Having an understanding of these issues before negotiating the LOI and purchase agreement is invaluable. It allows the seller to make informed decisions prior to and during the sale versus reacting to demands from the buyer after the fact. It takes a team of skilled professionals to work through these issues.

The team

Certified public accountant (CPA)

The CPA is a key outside advisor to the closely held business owner and the legal team. The CPA typically has regular contact with the business, has reviewed or prepared the financials, and understands the business structure as well as its operations. This individual can prove invaluable to the seller and legal counsel at every stage of selling a closely held business. This is especially so when making sure that the financials, forming the basis of the purchase price, are supportable. A seller’s failure to properly account for revenues, receivables, cash balances, and reserves can trigger post-closing holdback or true-up provisions that reduce the sales price.

Attorneys

Typically, a closely held business owner will require a few attorneys with different areas of specialization to complete a sale:

1. A corporate/transactional attorney to structure and execute the transaction documents.

2. An income tax attorney who may assist in structuring the purchase agreement to minimize income tax liability for the seller, such as proper apportionment between capital gains and ordinary income tax liability.

3. An estate planning attorney to create trusts and other related vehicles to mitigate income or transfer taxes (i.e., gift, estate and generation-skipping taxes) if the business owner’s overall estate tax dictates wealth planning to mitigate transfer taxes.

Investment banker

Usually, a closely held business owner has an accountant and an attorney, but it’s unlikely the owner has worked with an investment banker, business appraiser, or broker. For larger family businesses, choosing the right investment banker can be critical to maximizing the sales price. Investment bankers specialize in the purchase and sale of businesses, and so finding one who specializes in the closely held business owner’s industry can be key in determining proper valuation and identifying potential buyers with the capacity to close the deal.

With the right players on board, the selling owner can evaluate options to form beneficial legal structures, such as a NING Trust, in advance of the sale.

What is a NING trust?

A NING Trust is an irrevocable trust designed to reduce or eliminate the potential state income tax for high-income earners or on a significant capital gain incurred on the sale of an asset for business owners who live in a high-income-tax state[4]. An irrevocable trust is a trust in which the assets placed are no longer owned by the grantor (owner or seller). The trust has a third-party trustee, and the trust and the assets in it are considered outside of the grantor’s estate for income tax purposes. However, because the NING trust is a trust with an “incomplete” transfer status, it is still considered to be in the grantor’s estate for estate tax purposes. Because it is a non-grantor trust, the trust has a separate tax ID number and is the entity that pays the income taxes, not the grantor, and so is considered the owner of the assets. Because Nevada does not have a state income tax, a resident or a trust in Nevada would not owe state income taxes on the proceeds or profits from any assets.

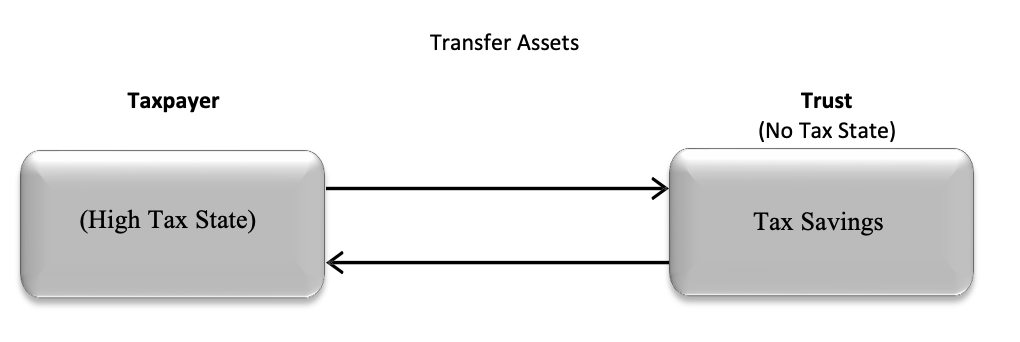

Incomplete gift, non-grantor (ING) trusts

When properly established, a NING trust could produce impressive tax savings. Given this, taxpayers in high-income-tax states should consider transferring assets to a trust in a state that does not tax trust income.

Example 1. Sally Founder owns a $5,000,000 investment portfolio that produces $600,000 of interest, dividends, and capital gains per year. Assume that Sally’s home state has a 12.3% income tax rate, but would not tax income from a trust created by Sally in Nevada. By transferring the investment portfolio to a NING trust and by satisfying certain other technical requirements in the trust document, Sally could save $73,800 per year in state income tax (0.123 x $600,000). If Sally could reinvest the savings at 10%, Sally’s initial savings if reinvested would increase by $496,489.50 over a 20-year period. This amount increases as additional annual state tax savings is factored into the equation. Larger tax savings might also be achieved by taxpayers holding assets with large capital gains on low-basis assets[5].

Example 2. John Developer, a resident of a state taxing long-term capital gains at 10%, owns an apartment complex with a basis of $5,000,000 and FMV of $11,000,000 owned by a corporation. If John transferred the corporate stock to a NING, like the one in Example 1, he could save $600,000 of state capital gains tax (0.10 x $6,000,000 gain).

Taxpayers residing in states with high-income taxes with large unrealized capital gains or a regular stream of ordinary income from an investment portfolio who have always wanted to find a way to eliminate or minimize their state income tax exposure without giving up the economic benefit of the underlying assets would benefit from using the NING. Moreover, the taxpayer can reinvest the annual tax savings, and so the savings would continue to grow exponentially.

Structuring the trust

Transactions utilizing a NING trust should be carefully structured to satisfy the following requirements:

- The trust must be established in a state that does not tax trust income.

- The income from the trust must not be taxable by the founder’s (“grantor”) home state.

- The trust must allow discretionary distributions to the grantor without making the trust a grantor trust.

- Transfers into the trust must be incomplete gifts for federal gift tax purposes without having the trust become a grantor trust.

As noted above, NING trusts are largely supported by a series of private letter rulings issued by the IRS[6]. to utilize a NING trust, there are three critical points to consider. First, any potential state tax reduction only applies to investment income-producing assets. It generally does not apply to compensation, to income from a trade or business, or to rents, royalties, or gains derived from ownership of tangible property. The second point is that the individual owner of the income-producing asset must transfer it into a special trust well in advance of any liquidation event. Third, that trust must be administered in Nevada (or a suitable state that has approved self-settled trusts) by a Nevada trustee and generally must not have a trustee located in the grantor’s home state. States like California also require that there are no other California fiduciaries, and no California resident beneficiaries, except if their interests are contingent.

1. Trust must be located in a state that doesn’t tax trust income

The ING trust must be established in a state that: (1) will not tax trust income, (2) has a domestic asset protection trust statute, and (3) permits the settlor to retain a lifetime and testamentary non-general power of appointment. Nevada law satisfies these requirements and has become the most popular state for ING trusts. Other states that permit ING trusts include Alaska, Delaware, Ohio, South Dakota, and Wyoming. It is important for a settlor to consider if their home state will deem the trust to be a resident trust. For example, under California law, a trust is taxed on the income from intangible investment assets if a fiduciary (including a trustee) or a beneficiary (other than one whose interest in the trust is contingent) is resident in the state[7]. Unlike tangible property, intangible investment assets not associated with a business domicile in a state with income taxes are deemed to be situated where the trust is administered. For NINGs that is Nevada[8]. The income from tangible property is traced to the location of the asset, while the income from intangible property – for example, the passive investments of a typical trust portfolio – is traced to the residence of the owner. With a NING, the residency is Nevada, a state that imposes no income tax[9].

2. Trust not subject to tax in the settlor’s home state

Establishing the trust in one of the states listed above does not necessarily mean that the ING trust’s income will not be taxed by the grantor’s home state. Many states levy income tax on what they refer to as resident trusts. Resident trust definitions vary from state to state. For example, Connecticut, the District of Columbia, Illinois, Louisiana, Maine, Maryland, Michigan, Minnesota, Nebraska, Ohio, Oklahoma, Pennsylvania, Utah, Vermont, Virginia, West Virginia, and Wisconsin treat trusts as resident trusts if the grantor/settlor was a state resident when the trust became irrevocable, regardless of where the trust is domiciled. Other states treat out-of-state trusts as resident trusts based on some combination of the following factors: (i) whether the trust is administered in the state; (ii) whether the trustees live in the state; and (iii) whether the trust beneficiaries live in the state. Creating a trust in a state that does not tax trust income does not help if the trust income is taxable in the settlor’s home state anyway.

3. Discretionary distributions to the settlor

The trustee must be “adverse”[10] to the settlor and have the power to make discretionary distributions to the settlor so that the settlor can receive the trust income. However, this must be accomplished without making the trust a grantor trust. Failing to satisfy this requirement makes the trust income the personal income of the settlor, taxable by the settlor’s home state just like any other personal income. If the out-of-state trust is treated as a grantor trust, the settlor will be deemed to be the owner of the trust assets under IRC § 671 with all trust income reported on the settlor’s Form 1040. This issue is solved by having a committee, adverse to the settlor, whose consent is required in order for the grantor or the grantor’s spouse to receive discretionary distributions from the trust or for the trustee to accumulate income in the trust potentially subject to the grantor’s testamentary limited power of appointment.

Reg. § 1.677(a)-1(d) provides that a trust is treated as a grantor trust if the grantor’s creditors can reach the trust assets under applicable state law. Creditors can reach trust assets to the extent a trust allows unrestricted payments of income or principal to the settlor. However, if state law permits domestic asset protection trust (DAPT), then discretionary distributions will not make the trust a grantor trust.

4. Incomplete gift

Most taxpayers who transfer assets to a NING do not want the transfer to be subject to gift tax. And while available, the taxpayer may not want to use his/her gift tax exemption. In order to avoid imposition of gift tax, the grantor needs to retain enough control over the transferred assets to avoid making a completed gift subject to the federal gift tax but not create grantor trust status. This is accomplished by: (i) giving the settlor a testamentary special power of appointment over the trust assets, and (ii) requiring the consent of a distribution committee for any distributions to the settlor. The testamentary special power of appointment makes the transfer to the trust an incomplete gift and the distribution committee consent requirement allows the trust to avoid grantor trust status[11].

Red flags for state tax authorities

State taxing authorities may audit and challenge NINGs that are hastily prepared and designed primarily to avoid incurring state income tax on a particular transaction, such as the disposition of a block of highly appreciated stock. State taxing authorities will examine the timing and dates on transaction documents as part of their assessment. They may also be on the lookout for issues including:

- Funding a trust with assets that are certain or even highly likely to be sold shortly after the creation of the trust.

- Funding a trust with assets the grantor may require to sustain his standard of living.

- Selling a trust’s principal asset, then distributing all or a substantial portion of the proceeds back to the grantor.

Consequently, clients should avoid funding a NING trust with assets that are certain or even likely to be sold immediately after the creation of the trust. A NING trust can become even more vulnerable to attack if a sale of its principal asset is followed by a distribution back to the grantor of all, or a large portion, of the sale proceeds. If that were to occur, a grantor’s home state taxing authority might consider the transaction a “sham,” then send a formal notice of audit and assessment for any state taxes allegedly due. Likewise, the taxing authority could challenge the transaction on the basis of form over substance, assignment of income, or some similar theory where the advantages of the trust structure were effectively disregarded and thereby treat the grantor as the seller in fact who then owed the state income tax payments.

Other tax considerations

Clients should also consider certain potential offsets to any claimed NING income tax savings resulting from accumulations held in the NING trust. For example, the IRS irrevocable trusts income tax rates are compressed, reaching a 37% rate after $13,051 and higher[12], with the result that a built-in additional tax applies when a NING is used. So to the extent that relatively small amounts of investment income are involved, using a NING may be inefficient from a pure state income tax savings aspect. However, many business owners seeking the benefits of the NING are likely to have substantial income and already be in the highest tax bracket anyway. For them, this relatively minimal federal tax cost is easily offset by the tax savings that the NING delivers in states with excessive taxes rates, such as California.

NING trust offers asset protection for sale proceeds

A NING trust created under Nevada laws is considered to be a “self-settled” trust under NRS 166. This means the seller is the settlor and the primary beneficiary of the trust. The NING trust would be utilized if the seller has a desire to receive distributions from this trust. Although Nevada is not the only state to recognize this statute, Nevada is a very trust-friendly state and it is convenient for California business owners to utilize this structure as described below.

Estate planning

The earlier successful business owners can start making lifetime gifts, the more future appreciation they can transfer out of their estates. Until recently, many wealthy clients were reluctant to pay gift tax or use up the applicable exclusion amount of $12,060,000 (2022). Another concern clients have is that they might need the assets in the future or they don’t want to deal with a trustee and investment committee to manage assets. The increase in the applicable exclusion amount and the emergence of self-settled domestic asset protection trusts address these concerns. As a result, business owners may make completed transfers to a NING or other DAPT and retain a level of control over the invested assets. This technique allows business owners to remove significant value from their estates and still retain a substantial amount of their applicable exclusion, which can be used for future planning. For estate planning purposes, it is important to realize that asset transfers into a NING trust are considered to be an “incomplete gift.” The assets in a NING trust will be included in the asset owner’s estate and should receive a step up in cost basis at death, provided the low-cost basis assets are still existing in the trust. Moreover, if the transfer is made to a DAPT, the trustee can be given the discretion to make distributions to the settlor if needed. Lastly, the NING is especially suited to serve as a dynasty trust. In this regard, Nevada has a 365-year rule against perpetuities, Nev. Rev. Stat. Ann. §111.1031(1)(b), which dovetails into a private family foundation and family office arrangement very efficiently.

Conclusion

Subject to careful planning and execution, the NING trust is a powerful tax-planning tool for entrepreneurs and business owners contemplating the sale of a closely held business, stock, or investment portfolio to eliminate or minimize state income tax. The benefits are especially appealing when the taxpayer’s home state is a high-income-tax state, such as California. Investment income can be transferred into a NING trust and state income tax on the investment income of assets held in the NING trust can be avoided. Also, the transfer of assets into the NING trust is not a taxable gift for the purposes of the IRC. The NING trust utilizes a committee the settlor chooses to direct the trustee with respect to distributions for select beneficiaries. This arrangement allows for wealth administration, in an asset protection trust, for multiple generations.

This article was first published on advisorperspectives.com.

This blog post was drafted by Vincent Aiello, an attorney in the Las Vegas, NV office of Spencer Fane. For more information, please visit www.spencerfane.com.

[1]A full analysis of income and estate tax issues for the sale of a closely held business could fill a library. This article provides a general summary of various tax considerations specific to NING trusts used in asset sales.

[2]Pursuant to Section 1202(a)(4), the exclusion percentage for newly issued QSB stock is currently 100%, coupled with a corresponding 100% exclusion for alternative minimum tax (AMT) purposes. Excluded gains under Section 1202(a)(1) are also not subject to the 3.8% Medicare tax imposed under Section 1411.3.

[3]A buyer may want to make this election if it would receive a stepped-up basis in the target corporation’s assets (i.e., if the buyer’s cost basis in target’s assets would exceed the carryover basis it would otherwise take in a stock acquisition). Stock Acquisitions: Tax Overview, Practical Law Practice Note Overview 9-383-6719.

[4]Note that ING trusts have been approved in numerous private letter rulings including PLRs 201310002, 201410001, 201440012, 201550005, 201613007, 202006002 and 202007010.

[5]Either strategy requires a comprehensive analysis of benefits prior to making any such transfer.

[6]See, e.g., I.R.S. Priv. Ltr. Ruls. 201310002 to 201310006 (Mar. 8, 2013); 201410001 to 201410010 (Mar. 7, 2014). See also PLR 200502014, (November 22, 2002) 200612002 (March 24, 2006), 200637025 (September 15, 2006), 200647001 (November 24, 2006), 200715005 (April 13, 2007) and 200731019 (August 3, 2007)). Pursuant to Rev. Proc. 2021-3, Incomplete Nongrantor Trusts have been placed on the no ruling list for 2021 by the Internal Revenue Service.

[7]See REV. & TAX. CODE 517742(a), (b).

[8]See generally CAL. CODE REGS. tit. 18, 517952(b): “Intangible personal property has a business situs in this State if it is employed as capital in this State or the possession and control of the property has been localized in connection with a business, trade or profession in this State so that its substantial use and value attach to and become an asset of the business, trade or profession in this State.”

[9]See, e.g., where under New York law residents do not enjoy the state tax benefits of a NING. As of January 1, 2014, any “ING” trust is treated as a grantor trust for New York state income tax purposes. N.Y. Tax Law § 612(b)(41). Thus, a New York grantor cannot establish a trust that is both an incomplete gift and a non-grantor trust but they could benefit from a completed gift.

[10]See generally IRC § 672(a) describing the meaning of “adverse parties.”

[11]See also CCA 201208026, where the IRS took the position that to make the gift incomplete, it is necessary to give the settlor a lifetime special power of appointment as well as a testamentary special power of appointment.

[12]Compare I.R.C. §1(e) (trusts) with §1(a)-(d) (other individual and joint filers); see also Rev. Proc. 2014-61 §3.01.