Nuclear Power Generation Globally. The U.S. Energy Information Administration (EIA) reports that, as of 2025, over 415 nuclear reactors operate in 31 countries, with 71% of global capacity concentrated in five nations: the U.S., France, China, Russia, and South Korea. See EIA website.

A surprise to many, the U.S. is the world’s largest producer of nuclear electricity. Domestically, nuclear electricity accounted for 782 gigawatthours (GWh), or 19% of the country’s electricity generation in 2024, which is 30% of the total production globally.

France maintains the second-largest nuclear reactor fleet in the world and the largest nuclear reactor fleet in Europe (57 reactors) with a total installed generating capacity of 63 GW. Nuclear reactors in France generated over 320 GWh of electricity in 2023, which was nearly 65% of the country’s total electricity generation. To strengthen its energy security following the global oil crisis of the early 1970s, developers built 52 nuclear reactors in France between 1975 and 1990.

China has the fastest nuclear growth rate in the world with 57 reactors commissioned since 1991. Another 28 reactors with a combined capacity of 30 GW are currently under construction. Once completed, China’s total installed nuclear capacity would surpass that of France. China’s operating reactors produced approximately 5% of China’s total electricity generation; it adapted the U.S. company Westinghouse’s AP1000 reactor design into its CAP1000 design.

Russia operates 36 nuclear reactors with a total installed generating capacity of 27 GW. Another four units totaling 4 GW are under construction. Rosatom, Russia’s state-owned nuclear energy corporation, is updating the country’s reactor fleet from the smaller, light-water graphite-cooled RBMK units to the larger and more efficient light-water only VVER-1000 and VVER-1200. Russia is currently the world’s largest vendor of nuclear generating technology.

South Korea started developing its nuclear power program in the 1970s and currently operates 26 reactors with another two reactors under construction. South Korea’s state-backed Korea Hydro & Nuclear Power is an international nuclear vendor; it built the United Arab Emirates’ Barakah power plant and will be the vendor for the Dukovany power plant expansion in the Czech Republic.

The U.S. – 54 Power Plants and 94 Reactors.1

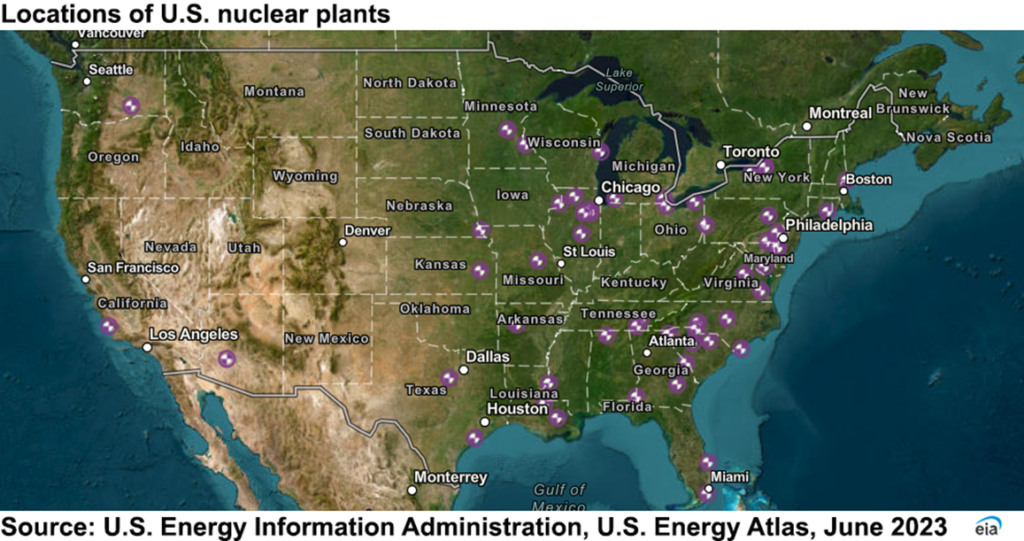

As of April 30, 2024, there were 54 commercially operating nuclear power plants with 94 nuclear power reactors in 28 states in the U.S.

Illinois has 11 reactors, the most in any state. Of the 54 operating nuclear power plants, 19 have one reactor, 31 have two reactors, four have three reactors, and one has four reactors.

The Alvin W. Vogtle Electric Generating Plant in Georgia is the largest U.S. nuclear power plant with four reactors. The R.E. Ginna Nuclear Power Plant in New York is the smallest nuclear facility with one reactor. The smallest individual reactors are the two units at the Prairie Island nuclear plant in Minnesota.

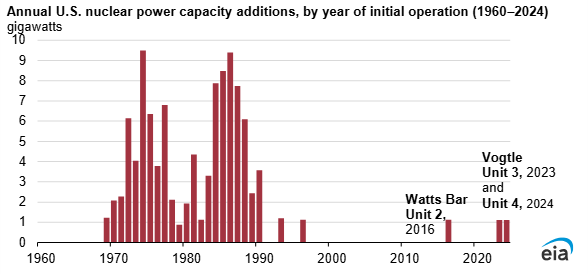

The Expansion of Nuclear Power Capacity in the U.S. Was Hobbled Between 1990 and 2024.

Nuclear energy expansion in the U.S. dropped after 1990 due to high construction costs, long project timelines, and competition from cheap natural gas. Following the 1979 Three Mile Island accident, stricter regulations, public opposition, and slowing electricity demand led to widespread project cancellations and a halt in new orders for decades.

Data source: U.S. Energy Information Administration, Annual Electric Generator Report

In spite of the hurdles, a consortium of utility partners2 succeeded in completing the newest nuclear reactor to enter service in the U.S. After 15 years of design, regulatory, and financial struggles, the Vogtle Unit 4 at the Alvin W. Vogtle Electric Generating Plant in Georgia began commercial operation in April 2024.

Construction at the two new reactor sites began in 2009. Originally expected to cost $14 billion and begin commercial operation in 2016 (Vogtle 3) and in 2017 (Vogtle 4), the project ran into significant construction delays and cost overruns. Georgia Power now estimates the total cost of the project to be more than $30 billion. Vogtle Units 3 and 4 are the first and only U.S. deployments of the AP1000 Generation III+ reactor.3

What’s Driving the Interest in Nuclear?

Decarbonization. Reducing carbon emissions (decarbonization) is a major driver behind the development of modern nuclear power technologies. Nuclear serves as a reliable, baseload, low-carbon energy source and will help meet “Net Zero” goals by providing 24/7 power and serving as an alternative to fossil fuels.

AI Data Centers. The demand for energy required by artificial intelligence data centers is a significant force behind development of new nuclear power technologies discussed below that focus on accelerating commercial deployment of Small Modular Reactors (SMRs), and deployment of Gen III+ light-water reactors.

4,000 Data Centers in Operation; 3,000 Planned/Under Construction. To support AI, over 4,000 data centers are in operation today in the U.S., with nearly 3,000 more planned or under construction. The heaviest concentrations are in Virginia, Texas, and California. Major hubs include Northern Virginia (known as Data Center Alley)4, Dallas, Silicon Valley, and emerging spots in Ohio, Arizona, and Oregon.

This interactive map shows the location of the data centers.

To Meet that Demand, What’s Happening Now?

Let’s start with Terra Power, a Bill Gates company. Nuclear power will emerge in the middle of “coal country.” On May 4, 2023, Bill Gates described his project:

Today I’m in the town of Kemmerer, Wyoming, to celebrate the latest step in a project that’s been more than 15 years in the making: designing and building a next-generation nuclear power plant. I’m thrilled to be here after all this time – because I’m convinced that the facility will be a win for the local economy, America’s energy independence, and the fight against climate change.

It’s called the Natrium plant, and it was designed by TerraPower, a company I started in 2008. When it opens (potentially in 2030), it will be the most advanced nuclear facility in the world, and it will be much safer and produce far less waste than conventional reactors. [Emphasis added.]

The sodium fast reactor design is described by Terra Power:

Unlike today’s Light Water Reactors, the Natrium reactor is a 345-megawatt sodium fast reactor coupled with TerraPower’s breakthrough innovation – a molten salt energy storage system, providing built-in gigawatt-scale energy storage. This makes the plant a perfect support for high-renewable penetration grids where variable power output is a concern. [Emphasis added.]

A $4 billion project ($2 billion of which will ultimately come from the U.S. Department of Energy pursuant to its Advanced Reactor Demonstration Program (ARDP))5, the Natrium plant will generate enough energy to power about 250,000 homes – with a capability of ramping up to 500 megawatts for short periods of time. The reactor will use high-assay, low-enriched uranium (HALEU) fuel.

And on the Data Center Side? Meta Signs Up for Eight of the Natrium Reactors. On January 9, 2026, TerraPower and Meta announced an agreement to develop up to 8 Natrium reactor and energy storage system plants in the U.S. Acknowledged as Meta’s largest investment in advanced nuclear technology, Meta will get up to 2.8 GW of carbon-free baseload energy. The Natrium technology will provide the capacity to boost total output to 4 GW of power. Under the commercial agreement, Meta will provide funding to support the deployment of the Natrium plants, with delivery of initial units as early as 2032.

Advanced SMRs. The International Atomic Energy Agency (IAEA) describes SMRs at its website this way:

Small modular reactors (SMRs) are advanced nuclear reactors that have a power capacity of up to 300 MW(e) per unit, which is about one-third of the generating capacity of traditional nuclear power reactors. SMRs, which can produce a large amount of low-carbon electricity, are:

-

- Small– physically a fraction of the size of a conventional nuclear power reactor.

- Modular – making it possible for systems and components to be factory-assembled and transported as a unit to a location for installation.

- Reactors – harnessing nuclear fission to generate heat to produce energy.

The IAEA produces an excellent audio series, Nuclear Explained – Nuclear Reactors and the Future of Nuclear Power, explaining the advanced nuclear reactor and SMR concepts and designs. Of note is that globally, as of mid-2025, there are over 127 identified small modular reactor designs at various stages of development, with over 30 countries actively exploring their deployment. While many are in conceptual stages, seven designs are either currently operating or under construction in countries like China and Russia.

The DOE’s $800 million Investment in SMRs.

The U.S. Department of Energy has selected the Tennessee Valley Authority (TVA) and Holtec Government Services to receive up to $400 million each in cost-shared funding for early deployment of advanced small modular reactors (SMRs).

TVA will build the GE Vernova / Hitachi BWRX-300 reactors at its Clinch River site. The federal funding will also assist TVA in its plans to deploy other SMRs in partnership with Indiana Michigan Power and Elementl.

Holtec will build its SMR-300 units at the Palisades plant in Michigan, aiming for early 2030s operation.

Portables? One MW Portable Microreactors Designed to Replace Diesel Generators.

Radiant Nuclear has announced that it plans to test Kaleidos, a 1 MW portable, gas-cooled nuclear microreactor designed to replace diesel generators, at Idaho National Laboratory’s DOME facility in summer 2026. The trailer-sized unit is intended for military bases and remote, critical applications, with initial customer deployments scheduled to begin in 2028.

The Future? A Complex Balancing Act. The future of nuclear energy in the U.S. stands at a critical juncture, balancing the urgent necessity of carbon-free baseload power against significant economic and logistical headwinds. While the resurgence of interest in SMRs and advanced, next-generation technologies offers a pathway to faster, safer, and more flexible deployment, the industry must overcome high capital costs, supply chain limitations, and regulatory challenges to succeed.

To achieve ambitious net-zero carbon emission goals, provide electricity for thousands of AI data centers that are now operating and planned, and to ensure grid reliability, a sustained commitment from both the public and private sectors is required to modernize the nuclear industrial base and secure public trust. Ultimately, nuclear power is poised to remain a foundational pillar of the U.S. energy portfolio, but its long-term viability will depend on the successful, on-budget rollout of new, innovative designs.

This blog was drafted by John L. Watson, an attorney in the Spencer Fane Denver, Colorado, office. For more information, visit www.spencerfane.com.

—

1 https://www.eia.gov/tools/faqs/faq.php?id=207&t=2

2 The Alvin W. Vogtle Electric Generating Plant (Plant Vogtle) in Burke County, Georgia, is operated by Southern Nuclear and co-owned by a consortium of utility partners including Georgia Power (45.7%), Oglethorpe Power Corporation (30%), Municipal Electric Authority of Georgia (MEAG Power – 22.7%), and Dalton Utilities (1.6%). See the Southern Nuclear website

3 See the EIA description.

4 See article by Upstack

5 See DOE website

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.