An Irrevocable Life Insurance Trust (ILIT) offers a valuable opportunity for all clients – regardless of their net worth – to shield the death benefit proceeds of life insurance policies from estate taxes, creditors, and unintended beneficiaries. These proceeds, which are free from estate taxes, can serve as a source of liquidity to cover any estate taxes that may apply to the rest of your estate. This can be particularly advantageous for families with substantial assets tied up in non-liquid forms such as business interests, investments, or real estate.

Benefits of an ILIT

An ILIT serves as a vehicle for holding life insurance policies, which are gifted or sold by the grantor to the trust for the benefit of specific beneficiaries, typically the grantor’s spouse and descendants. Key benefits of an ILIT include:

- Simple to Create: The grantor can transfer ownership of a life insurance policy to the ILIT, either by gift or sale, with the intended beneficiaries designated to receive the policy benefits.

- Simple to Use to Address Estate Tax: Proceeds from the policies held in an ILIT may be used to purchase assets from the grantor’s taxable estate thereby providing the estate with liquidity without having to sell the estate’s assets to third parties at a discount.

- Flexibility Regarding Policies: An ILIT can own policies that insure the lives of more than one individual, with benefits payable upon the death of all insured parties, and can own different types of policies (term, whole life, etc.) depending on the goals of the grantor.

- Facilitates Management of Assets: When the death benefit is paid to an ILIT, the trustee of the ILIT manages the investment of the funds for the benefit of the beneficiaries who may lack the financial sophistication to manage such a large amount of assets themselves.

- Beneficiary Protections: An ILIT may be structured to provide several protections for beneficiaries, including:

- Estate Tax Protection: The life insurance policies and their proceeds are shielded from estate taxes upon the death of the grantor and future beneficiaries.

- Creditor Protection: Policy proceeds are safeguarded from creditor claims against the grantor or beneficiaries.

- Divorce Protection: Policies owned by and ILIT and the proceeds from such policies are typically not subject to division in divorce proceedings.

- Family Protection: As the beneficiaries of an ILIT may be fixed by the grantor, the grantor ensures that third parties (e.g., new spouses) do not take trust assets and, instead, the proceeds ultimately flow to the grantor’s intended beneficiaries.

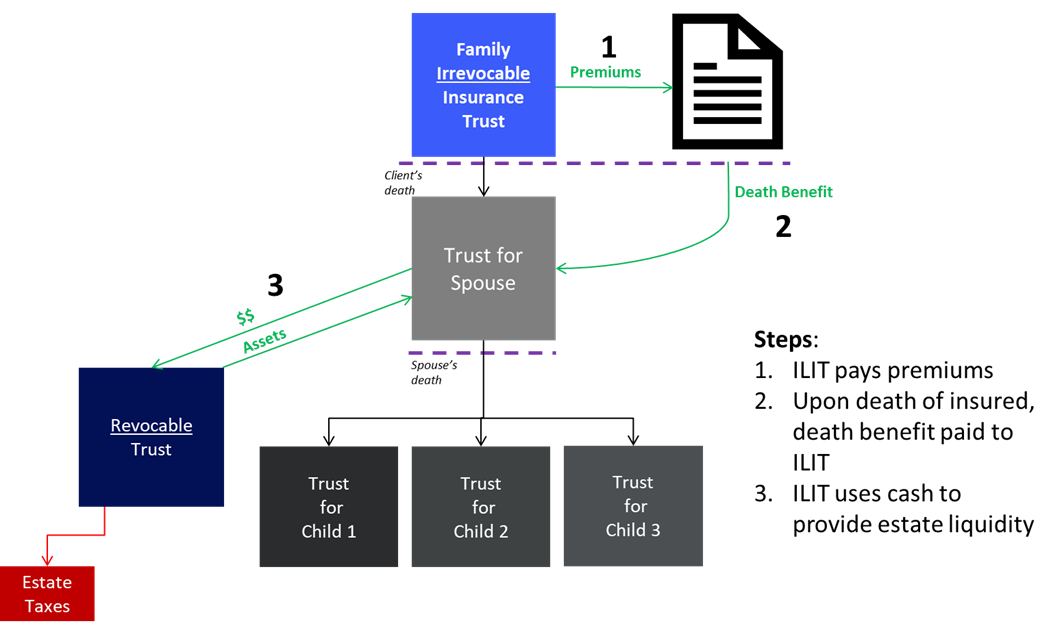

Operation of an ILIT:

- During the Lifetime of the Insured: During the grantor’s lifetime, the trustee administers the ILIT assets to pay premiums on the life insurance policies held by the trust.

- Upon the Insured’s Death: After the grantor’s death, the trustee manages ILIT assets for the benefit of the designated beneficiaries, providing financial support during their lifetimes.

Risks of an ILIT:

- Irrevocable Trust: An ILIT is an irrevocable trust, meaning that once assets are transferred to it as a gift, the transfer cannot be reversed or undone.

- Administration of ILIT: To fulfill its objectives effectively, strict technical rules must be adhered to when funding and managing the ILIT.

ILIT Illustration:

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona office. For more information, visit www.spencerfane.com.