A Lifetime Qualified Terminable Interest Trust (LQTIP) is an irrevocable trust designed to utilize the estate tax and GST exemption of a client’s spouse, whose exemption might otherwise be unused, in such a way that client can ensure that spouse is adequately provided for in a creditor protected manner. LQTIPs also provide flexibility in that, should the client survive the spouse, the client may remain the beneficiary of the LQTIP’s assets without such assets being included in the client’s taxable estate or subject to claims by the client’s creditors or future divorcing spouses.

Ideal Candidate for a LQTIP:

The ideal candidate for a LQTIP is a client who has a taxable estate but whose spouse does not have a taxable estate.

For example, a typical fact pattern is that a client has a $20 million dollar estate composed of client’s separate property and the spouse has a $1 million dollar estate, composed of the spouse’s separate property.

Should the client pass away prior to the spouse, the client wants the spouse to maintain the spouse’s current standard of living but also desires that the client’s assets ultimately are received by the client’s descendants.

The client may consider contributing $8 million to a LQTIP today, for the benefit of the spouse, which would remove $8 million from the client’s taxable estate and, should the client survive the spouse, would return to the client in an estate tax protected manner. Part of the $8 million, might be the primary residence of the client and spouse and a certain amount of cash or marketable securities to pay such residence’s expenses should the client pass away before the spouse.

Mechanics of a LQTIP:

Creation of LQTIP:

- Creation: The client transfers assets to an LQTIP for the benefit of the spouse. The transfer does not utilize the client’s lifetime estate and GST exemption.

- Management: The client is able to choose a trustee to manage the LQTIP during the spouse’s lifetime. If the client is concerned that a family member or friend might not be the best person to serve as trustee, the client may consider appointing a corporate trustee.

Operation of LQTIP During Spouse’s Lifetime:

- Payments of Income: LQTIP must pay its income annually to the spouse during the spouse’s lifetime. Depending on what the LQTIP is funded with, for example if the LQTIP is funded with a family home, the LQTIP might not have income to distribute. However, the spouse is given the power to compel the trustee to convert non-income producing property into income producing property (note that the spouse does not have to exercise this power). Such income can be used by the spouse to maintain the family home during the spouse’s lifetime.

- Principal Payments: The client may choose to design the LQTIP to allow the trustee to make payments of principal to the spouse (for example, for the spouse’s health, education, maintenance, or support) or the client may choose to prohibit distributions of the LQTIP’s principal to the spouse, ensuring that the principal ultimately ends up passing to the client’s descendants.

- Client Monitoring: As the client remains alive, the client is able to monitor the operation of the LQTIP and determine whether the spouse needs additional funding upon the client’s death to maintain the spouse’s standard of living. The client is also able to observe how the trustee manages the LQTIP for the spouse’s benefit and may, subject to certain limitations, adjust trustees as needed.

- Creditor Protection: As neither the client nor spouse legally own the assets held by the LQTIP, such assets may be protected from the client’s and spouse’s creditors.

Upon Spouse’s Death:

- Income Tax Efficient: Assets inside of the LQTIP are included in the spouse’s taxable estate; accordingly, under current law, the income tax basis of the assets receive a “stepped-up” basis to each asset’s fair market value.

- Estate and GST Tax Efficient: As the spouse has excess estate tax and GST exemption, the spouse’s exemption is applied to the LQTIP’s assets, which allow the assets and the growth of the assets to remain estate tax and GST tax free when they pass to subsequent beneficiaries (e.g., the client’s descendants).

- Client Can be a Remainder Beneficiary: If the client is still alive, then the LQTIP’s assets may pass into a family trust for the client’s benefit.

During Client’s Life and Upon Client’s Death:

- Client Maintains Control: After the spouse’s death, the client may be the beneficiary of the family trust and, depending on the drafting of the family trust, may serve as trustee of the family trust. Upon the client’s death, the client may be granted a limited power of appointment which gives the client the power to direct where the assets of the family trust go.

- No Estate or GST Taxes Upon Client’s Death: Assets inside of the family trust (created under the LQTIP) are not included in the client’s taxable estate for estate tax and GST purposes. Accordingly, the assets pass to the client’s descendants’ estate and GST tax free.

Risks of LQTIP:

Irrevocable Trust: An LQTIP is an irrevocable trust, which means that client is unable to make changes to the LQTIP once it has been created.

Administrative Requirements: To fulfill its objectives effectively, strict technical rules must be adhered to when funding and managing the LQTIP.

Divorce: Should the client and the spouse subsequently divorce, the spouse will remain the income beneficiary of the LQTIP for the spouse’s lifetime. Only after the spouse’s death will the remaining principal of the LQTIP pass to the client’s descendants.

Spouse Has Limited Control: As the spouse can compel the trustee to convert non-income producing assets into income producing assets, the spouse may be able to force the trustee to liquidate certain non-income producing assets.

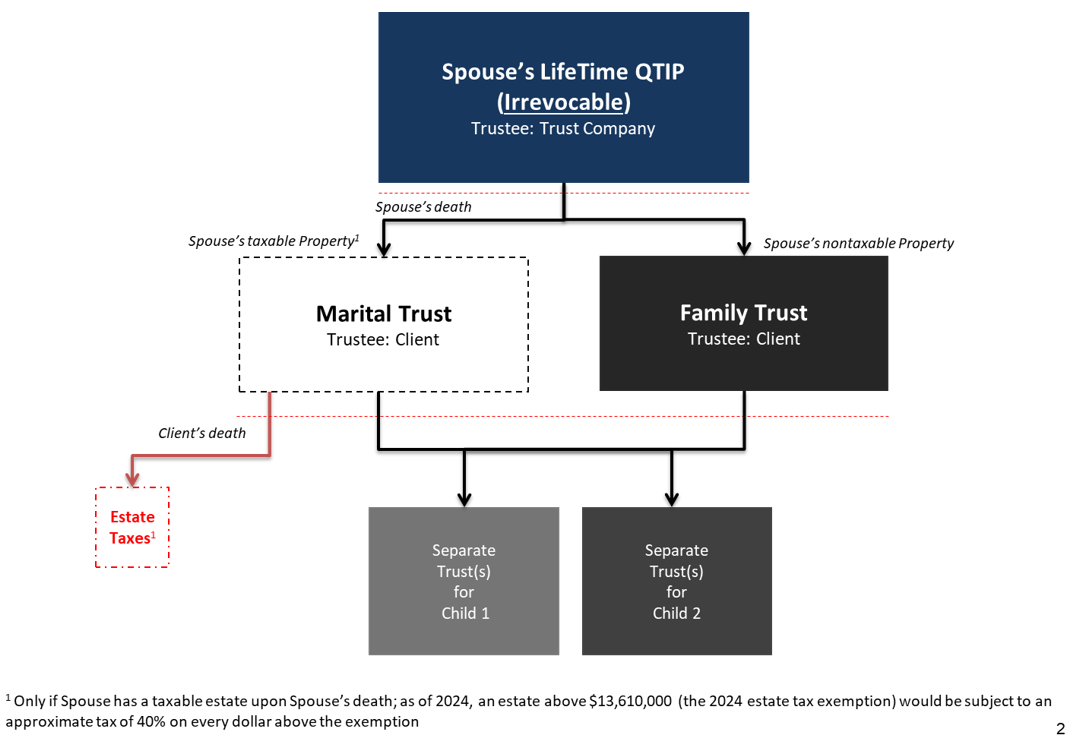

Illustration of LQTIP:

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona office. For more information, visit www.spencerfane.com.