Most clients have never heard of the generation-skipping transfer tax (commonly referred to as GST tax or GSTT). Yet for families seeking to transfer wealth to grandchildren or more remote descendants, the GST tax can impose a tax burden as severe as the estate tax itself, especially considering the GST tax applies in addition to the estate tax, not instead of it. The GST tax operates as a backstop to the estate tax system, ensuring that wealth cannot escape taxation simply by skipping a generation.

Here, I provide an overview of the GST tax, explain when it applies, and outline several planning strategies that may reduce or eliminate exposure in appropriate circumstances.

The Basic Mechanics of the GST Tax

The GST tax is imposed on transfers to individuals who are two or more generations below the transferor (i.e., the person making the gift); typically, the recipients are grandchildren or more remote descendants. For transfers to non-relatives, the recipient is a “skip person” if more than 37.5 years younger than the transferor. The tax rate is a flat rate of 40% of the fair market value of the transferred asset.

The math can be punishing. Consider a grandmother who wishes to leave $10 million directly to her grandchild at death and has fully utilized her estate tax exemption and GST tax exemption. The estate tax alone consumes approximately $4 million. The GST tax then imposes an additional 40% on the remaining $6 million (another $2.4 million), leaving the grandchild with only $3.6 million of the intended $10 million gift. The combined effective rate approaches 64%.

To prevent this result, Congress provided each taxpayer with a GST exemption. For 2025, the exemption is $13.99 million per person (increasing to approximately $15 million in 2026); married couples can effectively shield $27.98 million in 2025 or $30 million in 2026.

GST exemption allocation is tracked through two IRS forms. For lifetime gifts, Form 709 (the federal gift tax return) is used, and at death, Form 706 (the federal estate tax return) tracks the deceased person’s remaining GST exemption. Proper completion is essential; errors can result in unexpected tax liabilities that may not surface until decades later.

When the GST Tax Applies: The Three Triggering Events

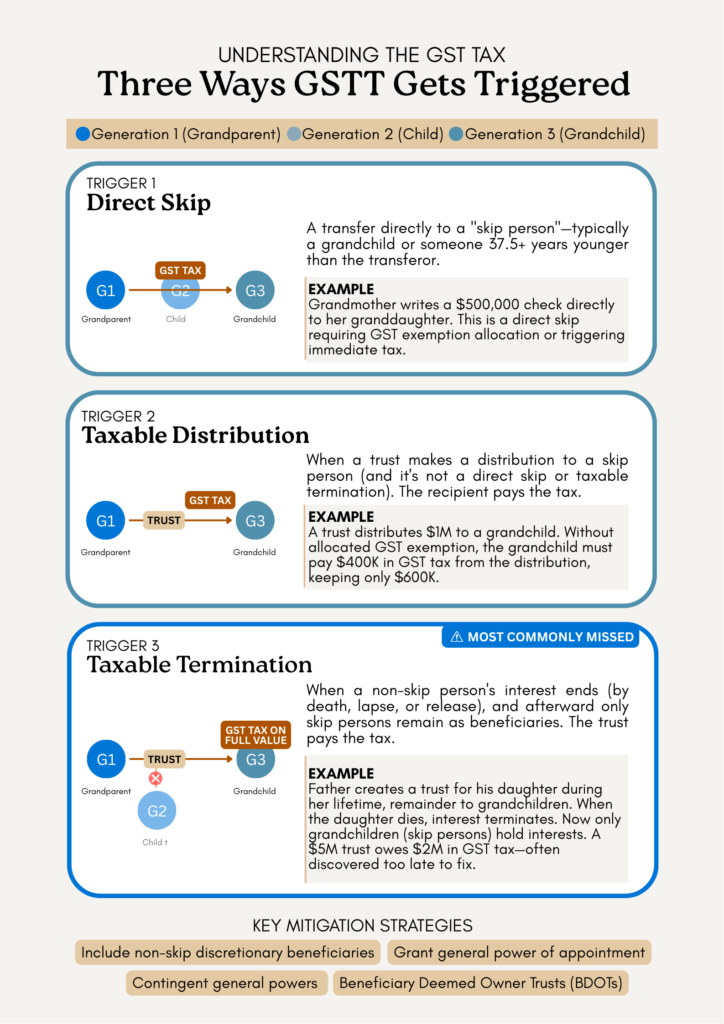

The GST tax applies to three distinct types of transfers.

Direct Skips

A direct skip is the most straightforward triggering event: a transfer of property directly to a skip person, either outright or to a trust in which only skip persons have interests. For a direct skip, the transferor is liable for the tax at the time of the transfer.

For example, if a grandfather writes a check for $500,000 to his granddaughter, this is a direct skip. He would need to allocate $500,000 of his GST exemption to shield the transfer. If he has no remaining exemption, he owes $200,000 in GST tax (in addition to any gift taxes that may be owed).

Taxable Distributions

A taxable distribution occurs when a trust makes a distribution to a beneficiary who is a skip person. Unlike direct skips, the recipient (i.e., beneficiary) not the transferor (i.e., creator of the trust) pays the GST tax.

This creates a “tax-inclusive” calculation. For example, if a trust without an allocated GST exemption distributes $1,000,000 to a grandchild, the grandchild must pay $400,000 in GST tax from the distribution, leaving only $600,000.

Taxable Terminations

The taxable termination is the least intuitive triggering event, and in my experience, it is the one most frequently overlooked. A taxable termination occurs when an interest in a trust terminates (e.g., by death, lapse of time, etc.) and immediately after, only skip persons hold interests in the trust.

Consider a trust established by a father, who did not allocate GST exemption to the trust, for the benefit of his daughter during her lifetime, with the remainder passing to grandchildren at her death. During the daughter’s lifetime, she is a non-skip person, so distributions to her do not trigger GST tax. At her death, however, her interest terminates, and only skip persons remain. This is a taxable termination. The trust owes GST tax on the full value of trust assets at that time. The consequences can be severe. A $5 million trust without a properly allocated exemption would owe $2 million in GST tax at the daughter’s death, reducing what passes to grandchildren to $3 million. Many families discover this exposure only after the non-skip beneficiary has died, when remedial options are limited.

A related trap: trusts with charitable remainder beneficiaries. If a trust provides income to a child for life, with the remainder divided between grandchildren and charity, the charity is technically a non-skip person. But because no future distributions may be made to the charity after the remainder vests, a taxable termination may still occur with respect to the grandchildren’s portion.

Strategies to Mitigate GST Tax Exposure

Several techniques can reduce or eliminate GST tax exposure when available exemption is insufficient.

Including Non-Skip Persons as Discretionary Beneficiaries

One direct method to prevent a taxable termination is ensuring that non-skip persons retain an interest in the trust at all times. If a trust permits distributions to the grantor’s (person who created the trust’s) children, grandchildren, and more remote descendants in the trustee’s discretion, the presence of children as potential beneficiaries prevents a taxable termination.

This approach requires careful drafting – the non-skip beneficiaries must have more than a nominal interest. The practical disadvantage: if the goal is to benefit grandchildren, including the children’s generation, may complicate distribution decisions. Some grantors address this by naming children as beneficiaries only for limited purposes (health and education) while providing broader discretion for grandchildren.

Granting a General Power of Appointment to a Non-Skip Person

A more sophisticated technique involves granting a non-skip person a general power of appointment over trust assets. Property subject to a general power is included in the power holder’s gross estate. Because the assets will be subject to estate tax at the power holder’s death, no taxable termination occurs; the transfer is subject to estate tax instead, and a new transferor is created for GST purposes.

This approach trades GST tax for estate tax. It may be advantageous when:

- The non-skip person has unused estate tax exemption;

- The non-skip person’s marginal estate tax rate is lower than 40%; and

- Low-basis assets would benefit from a stepped-up basis at death offsetting the cost of including trust assets inside the non-skip person’s estate.

The concern that the power holder may exercise the power inconsistently with the grantor’s wishes can be managed by limiting the power to a testamentary exercise or granting it over only a portion of the trust.

Contingent General Powers of Appointment

The challenge with granting general powers of appointment is that they may trigger estate tax inclusion; even when GST exemption has been successfully allocated and no GST protection is needed. A contingent general power solves this problem by springing into existence only if certain conditions are met.

Under this approach, the trust instrument provides that a general power will arise only if the trust’s inclusion ratio (i.e., the percentage of the trust subject to GST tax) exceeds zero at the non-skip beneficiary’s death. The inclusion ratio measures what portion of the trust remains subject to GST tax: a ratio of zero means fully GST-exempt; any ratio above zero means some portion is exposed (i.e., an inclusion ratio of one would mean that 100% of the trust is subject to the GST tax).

The mechanics work as follows. If GST exemption has been successfully allocated (inclusion ratio of zero), the contingent power never activates. The trust continues without estate tax inclusion at the beneficiary’s death, and future distributions to skip persons remain GST-exempt. If exemption allocation proves insufficient (inclusion ratio above zero), the power springs into existence. The trust is then included in the beneficiary’s estate, the beneficiary becomes the new transferor for GST purposes, and what would have been GST tax converts to estate tax.

This flexibility is the technique’s principal advantage. Estate tax inclusion is often preferable to GST exposure: the beneficiary may have unused estate tax exemption, the assets receive a stepped-up basis at death, and the beneficiary’s estate can allocate its own GST exemption going forward.

Beneficiary Deemed Owner Trusts

The Beneficiary Deemed Owner Trust (BDOT) originated as a solution to income tax inefficiencies but also provides meaningful GST planning benefits.

The income tax problem is straightforward: trusts reach the highest federal income tax bracket (37%) at approximately $15,650 (for the 2025 tax year) of taxable income, while individuals do not reach that bracket until income exceeds $500,000. A BDOT addresses this disparity by causing a beneficiary (rather than the trust) to be treated as the owner for income tax purposes.

The mechanism relies on IRC §678, which provides that a person other than the grantor is treated as the owner of any trust portion over which that person holds a power to vest corpus or income in himself (a withdrawal right). A BDOT grants a non-skip beneficiary or even another trust the unilateral right to withdraw trust income. Critically, the trust defines “income” broadly to include not only traditional accounting income but also capital gains and other taxable income attributable to principal. With this expanded definition, the entire trust may be treated as owned by the beneficiary or another trust for income tax purposes or even just a portion of the trust if the withdrawal right is more narrowly tailored.

The GST planning application follows from this structure. If a GST trust (not subject to the GST taxes) is treated as owned by a non-GST trust (subject to GST taxes), then the non-GST trust is responsible for the income taxes of the GST trust. As the non-GST trust is paying the income tax bill, the assets of the GST trust, which can pass free of GST taxes to skip persons, grow tax-free, while the non-GST trust’s assets, which will be subject to GST taxes, are reduced by the income tax payments. The goal being, over time, that the non-GST trust will be depleted while the GST trust will pass tax-free to future generations.

The technique requires careful attention to gift and estate tax mechanics and it is important to note that the IRS has not issued formal guidance specifically approving BDOTs, though the structure derives from established Internal Revenue Code provisions and Treasury regulations. Families considering this approach should consult with qualified tax advisors to evaluate whether the benefits justify the complexity.

Conclusion

The generation-skipping transfer tax represents a significant consideration for families whose wealth transfer objectives extend beyond children to grandchildren and more remote descendants. With proper planning, including thoughtful allocation of the GST exemption, and, where appropriate, implementation of the mitigation strategies discussed above, families can often minimize or eliminate exposure while achieving their broader estate planning goals.

Given the complexity of the GST tax rules and the severity of consequences when planning fails, consultation with experienced estate planning council is essential before implementing any strategy involving transfers to skip persons.

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona, office. For more information, visit www.spencerfane.com.

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.