Two things in life are certain: death and taxes, but taxes have the longer lifespan.

As if the death of a family member was not difficult enough, for families whose estates exceed or approach the federal estate tax exemption, approximately $13.99 million per person in 2025 or $15 million in 2026, there is an added complexity with the requirement of having to file a Form 706, the U.S. Estate (and Generation-Skipping Transfer) Tax Return.

This article provides a general overview of the timing, complexity, and potential pitfalls when preparing a Form 706 the filing of which can mean the difference between preserving family wealth and facing unnecessary penalties, audits, or forced asset sales.

Understanding the Dual Tax Challenge

Form 706 addresses two separate but interrelated taxes:

- The estate tax: Which applies when the gross estate plus adjusted taxable gifts exceed the exemption threshold; and

- The generation-skipping transfer (GST) tax: transfers to grandchildren or others more than one generation below the decedent (i.e. the person who died).

Both taxes share the same exemption amount – $13.99 million per person in 2025 or $15 million in 2026 – but require separate tracking and reporting.

Mismanaging either exemption can have lasting consequences. For instance, incorrectly allocating GST exemption to a trust might be the difference between grandchildren paying no taxes when they receive their inheritance or paying a 40% tax on that same inheritance.

Even for clients who do not expect to pay estate taxes at death oftentimes must properly file a Form 706. For example, under current federal estate tax laws a surviving spouse can oftentimes carryover the deceased spouse’s unused exemption (called the deceased spouse’s unused exclusion or DSUE), which would allow the surviving spouse to pass potentially double the amount of assets upon his or her death without having to pay estate taxes. However, if the Form 706 is not properly filed, this benefit can be lost.

The Complexity Behind Form 706

Filing Form 706 is not simply a matter of listing assets and calculating taxes owed. The return spans more than a dozen detailed schedules (A through Q, plus protective claims), each requiring specific valuations and documentation. Every asset must be reported and valued at its fair market value – real estate, closely held business interests, securities, digital assets, life insurance proceeds, and retirement accounts.

Consider an estate with a family business worth $8 million, real estate valued at $3 million, a bank account of $1 million, and investment accounts totaling $4 million.

The family must obtain qualified appraisals for the business and real estate, value securities as of the date of death (or an alternate valuation date), and coordinate with Form 1040 (the final individual income tax return) and Form 1041 (the estate’s income tax return).

Even seemingly straightforward “portability only” filings – where the estate is below the exemption but wants to preserve the DSUE for the surviving spouse – require complete and accurate preparation. One missing schedule or incorrect checked box can invalidate the entire election.

Critical Deadlines and Extensions

The general deadline for filing Form 706 is nine months after the decedent’s date of death, which means that the clock starts ticking even before a family has made funeral arrangements.

An automatic six-month extension is available by filing Form 4768, extending the filing deadline to 15 months after death, however this extension does not extend the time to make tax payments.

For estates not otherwise required to file (i.e., estates whose value is under $13.99 million), Revenue Procedure 2022-32 provides special relief for portability elections for the surviving spouse to receive DSUE. These estates can file up to five years after death, provided the return is complete and properly prepared. This extended deadline offers valuable flexibility but requires careful attention to compliance requirements, including specific language citing the revenue procedure as illustrated by a recent tax court case where the portability election was denied due to the improper preparation of Form 706.

The Liquidity Crisis: When Tax Bills Come Due

Many estates encounter their greatest challenge when forced to determine how to pay the taxes, as estate and GST taxes are generally due nine months after the decedent’s death, regardless of any filing extension. Extensions to file are not extensions to pay.

Estates heavy in illiquid assets – closely held businesses, farms, commercial real estate, or cryptocurrency – often struggle to raise cash quickly. For example, a single person’s estate consisting primarily of a $20 million manufacturing business, $10 million of commercial real estate and $4 million of other investments would be faced with having to pay approximately $8 million of estate taxes within nine months. This forces the family to make difficult choices: sell business assets at fire-sale prices, liquidate real estate in a down market, or seek relief through special provisions.

Two primary relief provisions are:

- Section 6161 which allows requests for extensions of time to pay by showing “reasonable cause” or “undue hardship”, with interest accumulating during any extension; and

- Section 6166 which permits installment payments with accumulating interest for closely held business interests that exceed 35% of the adjusted gross estate.

Planning for Payment: Avoiding the Fire Sale

Without planning, many families may be forced into difficult compromises. The family business built over generations might be sold to competitors at a fraction of its true value. Prime real estate could be liquidated during market downturns. These forced sales not only erode wealth but often destroy the very legacy the decedent worked to preserve.

Effective liquidity planning tools include irrevocable life insurance trusts to provide estate-tax-free cash, structuring business ownership to qualify for Section 6166 relief, and establishing trusts to optimize timing and use of exemptions. The key is developing a comprehensive plan before it’s needed, ensuring assets can pass to the next generation intact.

The High Cost of Misfiling

Errors in Form 706 can trigger cascading problems. Late or incomplete returns can result in loss of portability, depriving surviving spouses of millions in tax exemptions. Estate tax returns face frequent IRS examination – inadequate valuations or sloppy filings virtually guarantee disputes, audits, and substantial professional fees.

Common compliance pitfalls include incomplete schedules, missing or inaccurate appraisals, incorrect portability election language, and misallocating deductions between estate and income tax returns. Penalties and interest compound quickly, and extensions to file do not extend the payment deadline.

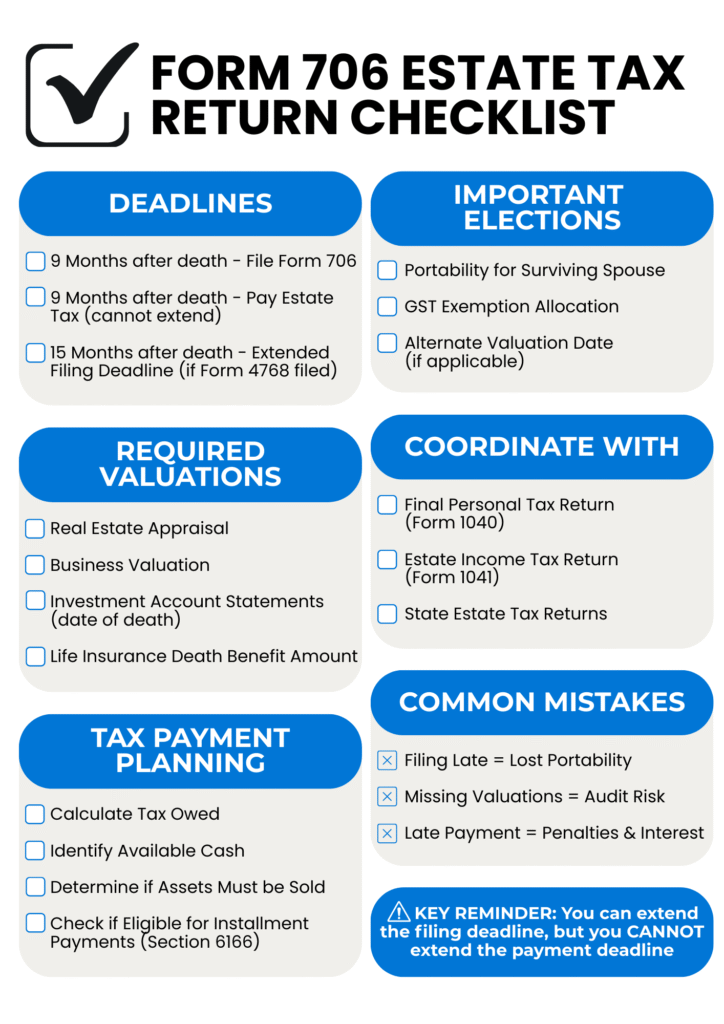

Form 706 Filing Checklist

Pre-Filing Requirements:

- Obtain federal employer identification number for estate

- Gather all asset valuations and engage qualified appraisers

- Compile complete list of lifetime gifts exceeding annual exclusions

- Review all beneficiary designations and asset titling

Key Deadlines:

- Note nine-month filing deadline (with possible six-month extension)

- Calendar nine-month payment deadline (no extension without special relief)

- Consider five-year portability election if the decedent’s estate did not exceed the lifetime exemption amount

Valuation Documentation:

- Qualified appraisals for real estate and businesses

- Date-of-death values for all securities

- Life insurance and retirement account statements

Coordination Requirements:

- Align with Form 1040 (final individual return)

- Coordinate with Form 1041 (estate income tax return)

- Allocate deductions appropriately between returns

Liquidity Planning:

- Calculate estimated tax liability

- Identify liquid assets available for payment

- Evaluate Section 6161/6166 eligibility if needed

- Consider asset sale timeline if necessary

Special Elections:

- Portability election (DSUE)

- Alternate valuation date if beneficial

- GST exemption allocation

- Qualified terminable interest property elections for marital trusts

Conclusion

Form 706 represents one of the most complex and consequential filings a family will face during an already difficult time.

The interplay of timing requirements, valuation challenges, and liquidity constraints demands careful planning and expert guidance. Consulting with your estate planning attorney, accountant, and financial advisor well before these issues arise can mean the difference between preserving your family’s legacy and watching it erode through taxes, penalties, and forced liquidations.

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona, office. For more information, visit www.spencerfane.com.

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.