Business owners face unique estate planning challenges that require specialized strategies to protect accumulated wealth, minimize tax exposure, and ensure successful transition of the business to future generations.

With proper planning, business owners can leverage strategies to achieve their personal and financial objectives while maintaining control during their lifetime. Here, I examine some of the key estate planning strategies and considerations specifically tailored for owners of closely held businesses.

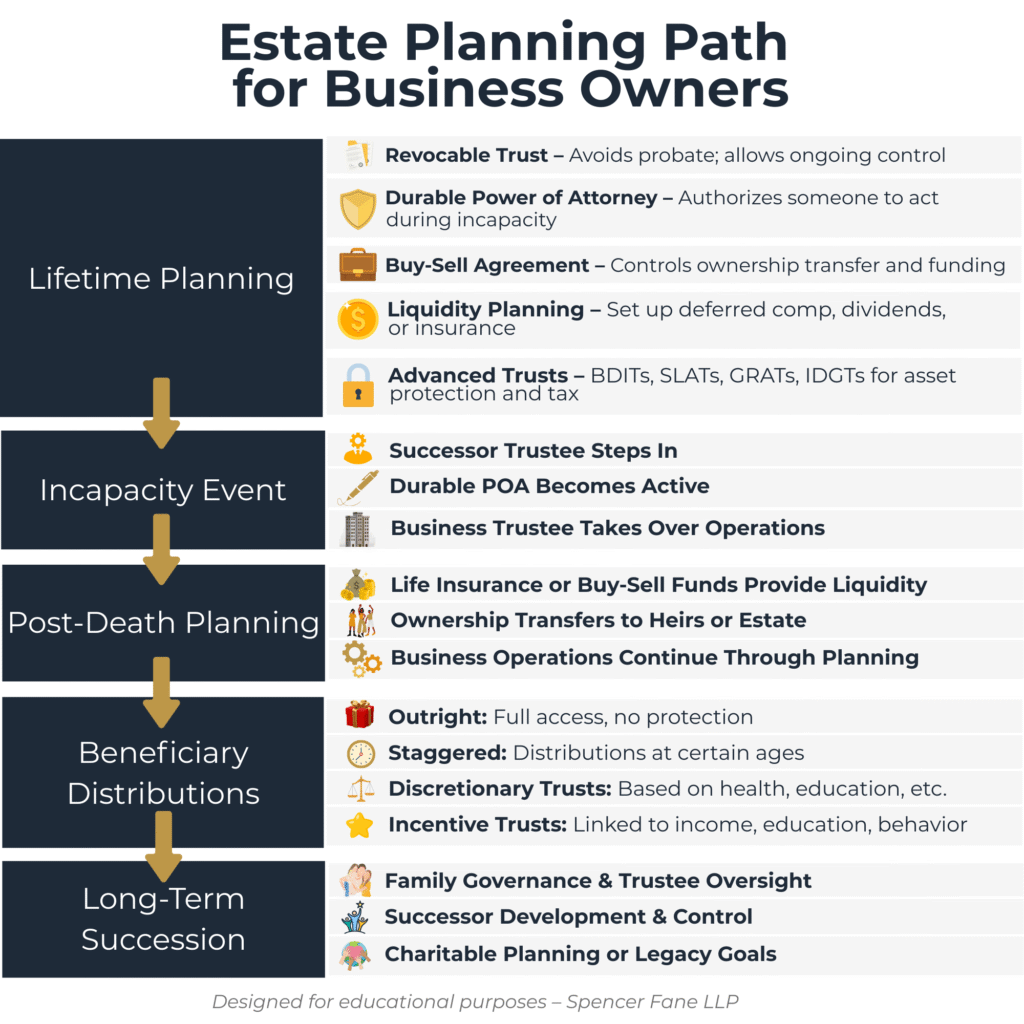

The Business Owner’s Estate Planning Landscape

Business owners typically hold the majority of their wealth in their business interests, creating concentration risk and liquidity challenges. According to available data, approximately 90% of the 14 million businesses in the U.S. are family owned and managed, with family businesses responsible for nearly half the gross national product.

T the Small Business Administration reporting that 90% of the 21 million U.S. businesses are family-owned, yet 80% of family businesses do not pass successfully to the second generation, and of the 20% that do, 80% never make it to the third generation. This statistic has created the saying “shirt sleaves to shirt sleaves in three generations” meaning that the first generation builds the wealth, the second uses the wealth, and then the third generation is tasked with rebuilding the wealth.

These sobering statistics underscore the critical importance of comprehensive estate planning for business owners. The challenges include:

- Liquidity constraints: Business interests are typically illiquid and difficult to value.

- Estate tax exposure: Concentrated wealth in a single asset increases estate tax vulnerability.

- Business succession: Many businesses are dependent on the owner for all things and there is not a clear line of succession should the owner become incapacitated or pass away.

- Family dynamics: Many business owners assume that children or other family members will be capable to run the business and have the desire to do so which is oftentimes an incorrect assumption.

- Asset protection: Absent proper planning, if a co-owner of a business is subject to a creditor’s claim or a divorcing spouse receives in interest in the business, the other co-owners may find themselves “in bed” with an undesirable party.

Essential Estate Planning Documents

Every business owner should maintain current estate planning documents that address both personal and business-specific concerns:

Revocable Trust: A revocable trust provides the foundation for comprehensive estate planning. Essentially what revocable trust is a vehicle to own legal title to property instead of having it inside of an individual’s personal name. A revocable trust offers several key advantages:

- Probate avoidance: Assets in the trust bypass costly and time-consuming probate proceedings.

- Privacy protection: Trust terms remain confidential, unlike probated wills.

- Disability planning: Successor trustees can manage assets if incapacity occurs; many businesses may consider incorporating a business trustee or advisor to manage the business assets while a general trustee administers the remaining (non-business) assets.

- Flexibility: The grantor retains complete control and can modify terms as circumstances change.

Durable Financial Power of Attorney: A Durable Financial Power of Attorney enables trusted individuals to manage business and personal affairs during incapacity, avoiding court-appointed guardianships. The power of attorney may specifically authorize business-related actions including:

- Voting shares or membership interests

- Executing business agreements

- Managing business operations

- Accessing business financial accounts

Buy-Sell Agreement: A properly structured buy-sell agreement is essential for any business with multiple owners or with key employees who would run the business should the owner become disabled or pass away. Key provisions should address:

- Triggering events: Death, disability, retirement, involuntary termination, divorce, or bankruptcy

- Valuation methodology: Fixed price, formula, or appraisal mechanisms

- Purchase obligations: Mandatory versus optional purchase provisions

- Payment terms: Lump sum or installment payments with appropriate interest rates

- Source of Liquidity for Purchase: To avoid having to sell any business or personal assets, many business owners will incorporate life insurance planning inside of buy-sell agreements to provide the surviving owner with liquidity to purchase the deceased owner’s interest in the business

- Transfer restrictions: Limitations on lifetime transfers to maintain ownership within desired groups

Planning for Incapacity and Survivor Liquidity

Cash flow for the surviving spouse represents one of the most critical issues in family business succession planning especially when the surviving spouse is unable to continue to run the business.

If the business owner has been taking cash out of the business in the form of compensation, the surviving spouse faces immediate concerns when, upon the death of the business owner, the paycheck stops.

Ways to address this issue include:

- Earmark life insurance proceeds specifically for income replacement.

- Set deferred compensation plans payable to the business owner on retirement and continuing for the surviving spouse’s lifetime.

- Implement written dividend policies during the owner’s lifetime to become applicable after death.

- Use buy-sell agreement proceeds if ownership interests are to be purchased

The business owner who believes the business will continue earnings uninterrupted by death must determine how those earnings will reach the surviving spouse. Without proper planning, there may be no mechanism to compel distributions, particularly if voting interests pass to active family members who prioritize business reinvestment over distributions to inactive owners.

Advanced Estate Planning Strategies for Business Owners

Many business owners rightly are concerned about creditor protection or mitigating the risks of estate taxes. The following provides a brief overview of common trust structures that business owners will use to mitigate these risks and considerations when implementing such trust structures.

Beneficiary Defective Irrevocable Trusts (BDITs): A BDIT allows business owners to move appreciating business interests outside their taxable estate in a creditor protected manner while maintaining control and access to the business.

Benefits:

- Assets grow income tax-free inside the trust while the owner pays income taxes from personal assets.

- Appreciation shifts outside the owner’s taxable estate

- Owner maintains control as trustee

- Creditor protection for trust assets

- Can backstop prenuptial agreements

Risks:

- This type of trust is complex and requires strict adherence to rules to properly administer

- This is a newer type of trust and has not been reviewed or litigated as thoroughly by the IRS or court system as much as more common trusts

- No basis step-up at death

Spousal Lifetime Access Trusts (SLATs): SLATs enable married business owners to remove assets from their taxable estates while maintaining indirect access through their spouse.

Benefits:

- Locks in lifetime gift tax exemption ($13.99 million in 2025)

- Spouse can receive distributions for health, education, maintenance, and support

- Assets and appreciation escape estate taxation

- Grantor trust status allows tax-free growth

Risks:

- Irrevocable nature of the gift

- Loss of access if divorce occurs

- No basis step-up at death

- Must avoid reciprocal trust doctrine if both spouses create SLATs

Intentionally Defective Grantor Trusts (IDGTs): Sales to IDGTs provide another powerful technique for transferring business interests while minimizing transfer taxes.

Benefits:

- Appreciation above Applicable Federal Ratepasses transfer tax-free

- Grantor’s payment of income taxes further reduces taxable estate

- Flexibility in note terms

- Professional trustee can manage business interests

Risks:

- Loss of control over business assets

- Irrevocable nature of the gift

- No basis step-up at death

Grantor Retained Annuity Trusts (GRATs): GRATs excel at transferring business appreciation to younger generations with minimal gift tax cost, particularly effective in low-interest rate environments.

Benefits:

- Appreciation above the required payments passes gift tax-free

- Minimal or zero gift tax on funding

- Can use rolling GRATs to capture ongoing appreciation

- Particularly effective for businesses expecting rapid growth

Risks:

- Can be complex to administer

- If assets depreciate, then the results are not as effective

- Loss of control after term

- Not an efficient way to transfer assets to grandchildren or more remote generations

Irrevocable Life Insurance Trusts (ILITs): ILITs provide liquidity for estate taxes while keeping insurance proceeds outside the taxable estate.

Benefits:

- Death benefits escape estate taxation

- Proceeds provide liquidity for estate taxes and business buyouts

- Can purchase business interests from estate

- Creditor protection for beneficiaries

Risks

- Life insurance premiums may be expensive

- Life insurance provides liquidity for estate taxes but does not reduce estate taxes

- The trust is irrevocable, making it more difficult to adjust for future changes in family dynamics

Trustee Selection and Conflict Considerations: The selection of appropriate trustees requires careful consideration of potential conflicts. Corporate fiduciaries may be unwilling to act as trustee when trust assets consist of ownership interests in a family business due to management responsibilities and fiduciary exposure. If the trust holds a controlling interest, corporate fiduciaries are naturally aware of the fiduciary responsibilities that accompany control.

Individual trustees present different challenges. A child who manages the family business may face conflicts between fiduciary duties to trust beneficiaries and obligations to the business and its owners. Key managers serving as trustees face similar conflicts, compounded by long friendships with the widow and emotional considerations.

If a surviving spouse is named as trustee, careful consideration must be given to distribution standards and powers to avoid estate inclusion. The spouse-trustee may have legitimate interests in cash flow that conflict with responsibilities to other beneficiaries, particularly in determining whether to vote trust-owned business interests in favor of dividends.

To address some of these conflicts, estate planning documents may acknowledge and waive conflicts of interest, authorizing individual trustees to act despite self-dealing prohibitions, provided they do not exercise powers resulting in general power of appointment problems. Furthermore, many business owners incorporate a business trustee to manage business assets and a general trustee to administer non-business assets.

Structuring Distributions to Beneficiaries

Business owners must carefully consider how beneficiaries will receive their inheritances.

Distribution Options:

- Outright distributions: Maximum flexibility but no asset protection

- Staggered distributions: Gradual transfer at specified ages

- Discretionary trusts with ascertainable standards: Beneficiary can serve as trustee

- Fully discretionary trusts: Independent trustee provides maximum protection

Incentive Provisions

To avoid creating “trust fund babies,” many business owners consider incorporating guidelines to ensure that family wealth exhibits good behavior rather than fueling bad behavior. Some examples of such guidelines are:

- Limit distributions to match beneficiary’s earned income

- Require completion of education milestones

- Provide matching funds for home purchases or business ventures

- Allow discretion for socially beneficial but lower-paying careers

Integration with Business Succession Planning

Estate planning must coordinate with business succession strategies:

Key Considerations:

- Separate business employment from ownership and control

- Identify and develop qualified successors

- Address compensation for active versus inactive family members

- Create mechanisms for buying out dissatisfied owners

- Ensure adequate cash flow for operations and owner buyouts

Planning Process:

- Update buy-sell agreements to reflect current circumstances

- Coordinate estate planning documents with business agreements

- Consider valuation discounts while planning for potential regulation changes

- Structure redemptions to maximize income tax efficiency

- Plan for adequate liquidity through insurance or installment provisions

Conclusion

Business owners face complex estate planning challenges requiring sophisticated strategies and careful coordination among legal, tax, and financial advisors. By implementing appropriate techniques such as BDITs, SLATs, GRATs, and IDGTs, business owners can achieve substantial transfer tax savings and asset protection.

Successful planning requires early action, as many strategies become less effective as business values increase and owners’ age. Business owners should work with experienced advisors to develop comprehensive plans addressing tax minimization, asset protection, liquidity needs, and succession objectives. With proper planning, business owners can preserve their life’s work for future generations while achieving their personal and charitable goals.

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona, office. For more information, visit www.spencerfane.com.

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.