A Beneficiary Defective Irrevocable Trust (BDIT) is an irrevocable trust used to move appreciating assets, such as business interests, outside of a client’s estate in a creditor protected manner. A BDIT is suitable for persons who want to bolster their personal creditor protection, mitigate their estate tax liability but who are not at the stage in life where it is desirable to gift assets.

Mechanics of a BDIT:

Third Party Creates BDIT: A third party, generally a friend or family member, creates the BDIT by making a $5,000 seed gift to the BDIT. The third party then names the client as the beneficiary and the trustee of the BDIT with distributions limited to an ascertainable standard (e.g., distributions may be made for the client’s health, education, maintenance, and support). The third party also grants the client the power to, effective at death, direct who receives the property upon the client’s death and what rules surround such receipt of property (i.e., a testamentary power of appointment).

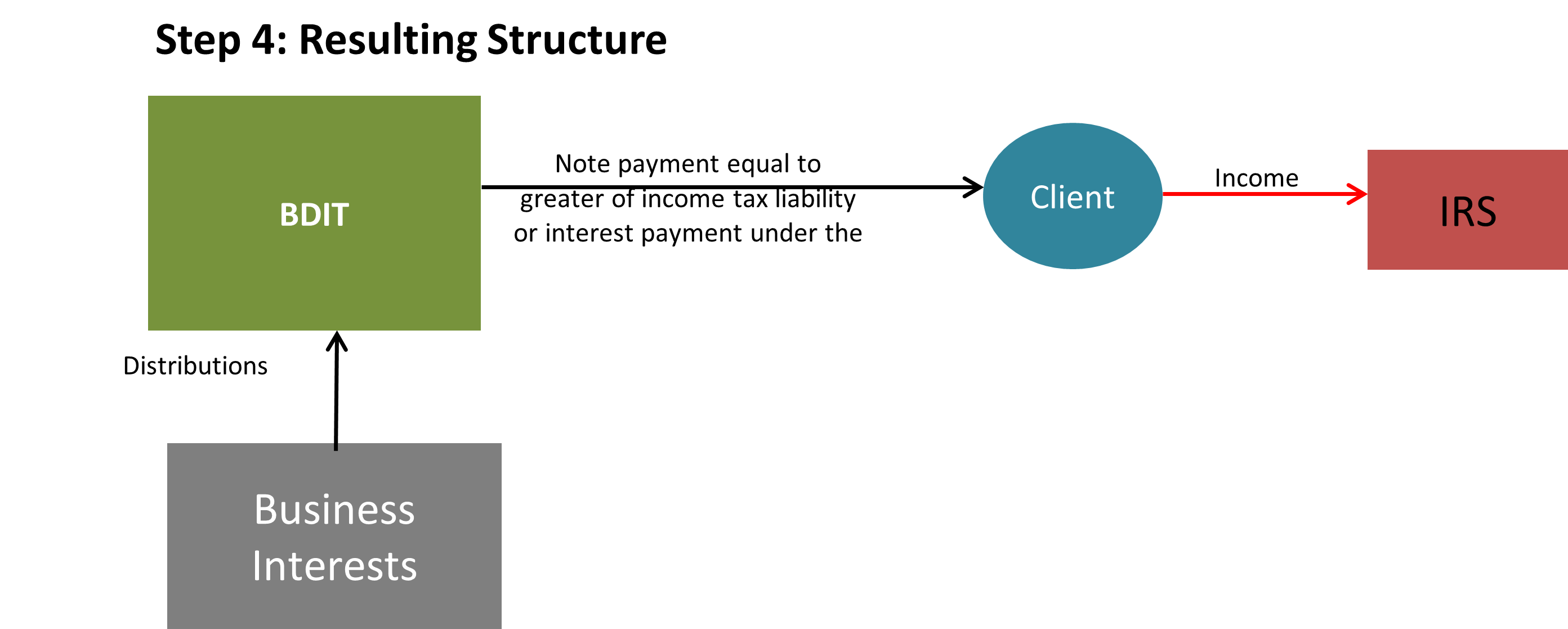

Grant of Powers to Client: The client is granted certain powers that, for income tax purposes, result in the BDIT being included in the client’s federal taxable income (i.e., powers that make the BDIT a “grantor trust” to the client). However, provisions are included that prevent the BDIT from being part of the client’s taxable estate or subject to claims by the client’s creditors. Essentially, the BDIT is the client for income tax purposes but is not the client for estate tax purposes or creditor purposes.

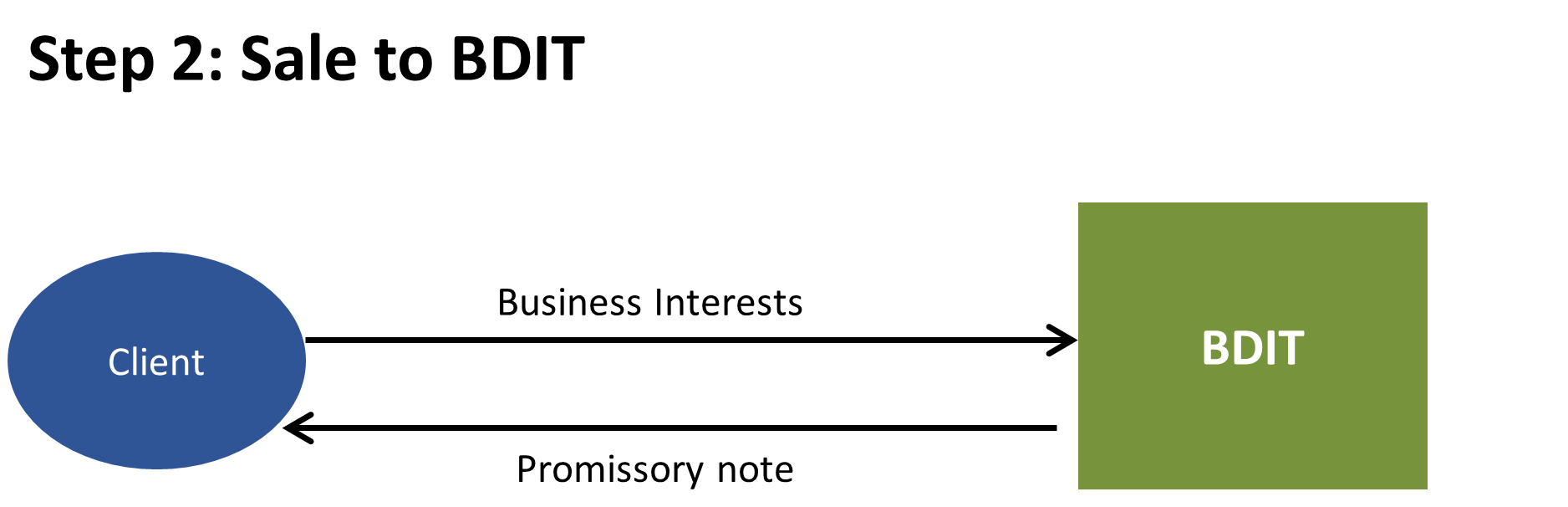

Client Sells Assets to BDIT: The client will then sell assets to the BDIT in exchange for a promissory note. As the BDIT is only funded with $5,000, it is essential that a third party act as a guarantor for at least 10% of the sale price in exchange for a guarantee fee; oftentimes, the client will create an irrevocable trust for the benefit of the client’s descendants, contribute assets equal to 10% of what will be sold to the BDIT, and will then have the irrevocable trust for descendants act as the guarantor to keep the guarantee fee inside

Client Administers the BDIT: As the trustee, the client maintains the ability to invest, purchase, loan, and sell assets inside of the BDIT and can make distributions subject to BDIT’s distribution standards.

Benefits of a BDIT:

Shift of Appreciation and Income Tax Burn: As the client is responsible for the income taxes on the BDIT’s assets, the assets inside of the BDIT grow income tax free (almost akin to a 401(k)) whereas the client is using assets inside of their estate, which might otherwise be subject to estate taxes or creditor claims, to pay the income tax liability. The result of this approach is that the client burns down “bad” assets (assets subject to estate taxes and creditor claims) while growing “good” assets (assets not subject to estate taxes or creditor claims).

Potential Discount of Assets Sold: Assets sold to a BDIT are sold for prices at which such assets would be sold to an unrelated third party. Accordingly, discounts that would commonly be included in a sale to a third party (e.g., marketability discounts, minority interest discounts, etc.) will be incorporated into the sale to the BDIT which can result in an immediate gift and estate tax mitigation.

Client maintains control of assets: As the client is the beneficiary and oftentimes the trustee of the BDIT, the client continues to manage and control the assets for their benefit.

Backstop a prenuptial agreement: BDITs are oftentimes used to backstop the provisions of a prenuptial agreement and as a means of segregating personal assets from marital assets. For example, in addition to challenging a prenuptial agreement, a divorcing spouse would need to also invalidate the BDIT, which adds another layer of defense.

Creditor Protection: The assets held within the BDIT should be safeguarded from claims by creditors of the client or any trust beneficiaries. Similar to a domestic asset protection trust, a BDIT adds another layer of defense which deters creditors from making claims and encourages settlements instead of prolonged litigation.

Risks of a BDIT:

Promissory Note Subject to Estate Taxes: As assets are sold to a BDIT in exchange for a promissory note, the promissory note which the client receives may be subject to estate taxes should the client have a taxable estate upon the client’s death.

Administrative Requirements: To fulfill its objectives effectively, strict technical rules must be adhered to when funding and managing the BDIT.

Loss of a Stepped-Up Basis for Income Taxes: Upon the client’s death, assets held within the BDIT may not receive a basis adjustment for income tax purposes, affecting future tax implications for beneficiaries.

Lack of Administrative Guidance: While BDITs are structured to comply with the provisions of the Internal Revenue Code, unlike other trusts used to mitigate estate taxes (e.g., Spousal Lifetime Access Trusts or Irrevocable Life Insurance Trusts), there is limited administrative guidance or court decisions with regards to the mechanics of a BDIT.

Illustration of BDIT:

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona office. For more information, visit www.spencerfane.com.

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.