Married couples face unique estate planning considerations when relocating between separate property states (such as Oregon or Colorado) and community property states (such as Arizona, California, or Washington). The characterization of property as separate or community has profound implications for income tax planning, estate tax minimization, asset protection, and wealth transfer strategies. Understanding these distinctions – and implementing appropriate planning techniques – can mean the difference between preserving income and estate tax savings or inadvertently triggering unnecessary tax liabilities and unintended property divisions.

This article examines the critical considerations for married couples navigating these interstate moves, providing practical strategies to maximize tax benefits while avoiding common pitfalls that could undermine carefully crafted estate plans.

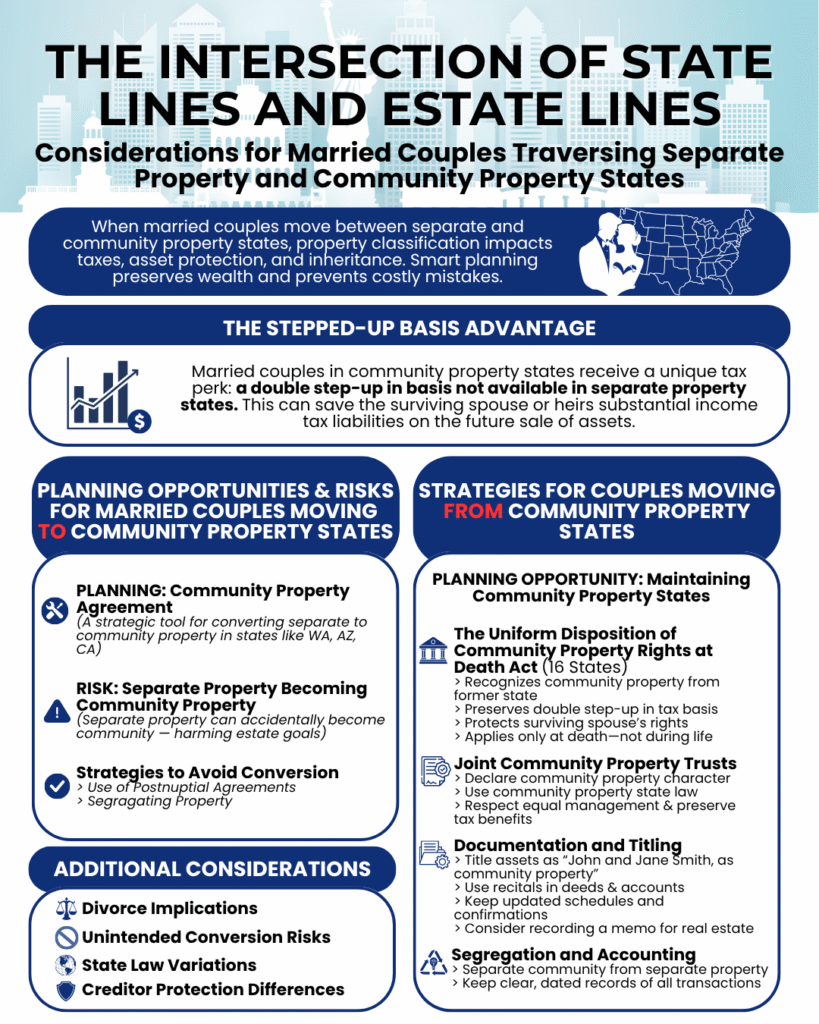

The Stepped-Up Basis Advantage

The most compelling tax benefit of community property lies in the “double” step-up in tax basis available under current tax laws. This provision creates a significant advantage for married couples in community property jurisdictions compared to their counterparts in separate property states.

In separate property states, when the first spouse dies, only the deceased spouse’s assets receive a stepped-up income tax basis to the asset’s fair market value. The surviving spouse’s separately owned assets retain their original cost basis.

Consider a married couple in Colorado who purchased investment property in 1990 for $500,000, taking title as tenants in common with equal shares. By 2025, the property has appreciated to $5 million. Upon the first spouse’s death:

- The deceased spouse’s 50% interest receives a stepped-up basis to $2.5 million.

- The surviving spouse’s 50% interest retains its $250,000 basis.

- Accordingly, the surviving spouse’s basis is $2.75 million.

- If the surviving spouse later sells the property for $5 million, capital gains tax applies to $2.25 million of gain.

In contrast, if this same couple resided in Arizona and held the property as community property, both halves would receive a stepped-up basis upon the first spouse’s death:

- The entire property receives a new basis of $5 million.

- The surviving spouse could sell immediately with no capital gains tax.

- Tax savings at current capital gains rates: approximately $535,000 (assuming 23.8% combined federal and state rates).

This disparity becomes even more pronounced with highly appreciated assets such as closely held business interests or real estate. For a couple with a $20 million estate consisting primarily of appreciated assets with a $2 million basis, the community property advantage could save the surviving spouse over $4 million in capital gains taxes.

Planning Opportunities and Risks for Married Couples Moving to Community Property States

Couples relocating from separate property jurisdictions to community property states have unique opportunities to restructure their assets for income tax efficiency. However, these benefits require deliberate action – merely moving to a community property state does not generally convert existing separate property to community property.

Planning Opportunity: Community Property Agreement

The most effective tool for converting separate property to community property is a comprehensive community property agreement. These agreements, recognized in states like Washington, Arizona, and California, can accomplish three primary objectives:

- Convert all or specified existing separate property to community property.

- Establish that future acquisitions will be community property.

- Allow for assets at the death of the first spouse to receive a full stepped-up basis for federal and state income tax purposes.

For example, a couple moving from Illinois to Arizona with $15 million in separate investment accounts could execute a community property agreement converting these assets from separate property to community property. This simple document could ultimately save the survivor of them approximately $1.8 million in capital gains taxes on the appreciation.

Risk: Separate Property Becoming Community Property

While community property agreements create intentional conversions, couples must also guard against unintended commingling that could frustrate estate planning objectives.

Couples may wish to maintain separate property character for:

- Assets intended for children from prior marriages;

- Property subject to prenuptial agreement provisions;

- Business interests requiring independent control; and

- Assets with potential creditor exposure.

Common pitfalls that may result in separate property being deemed community property include:

- Depositing separate property sales proceeds into joint accounts without proper documentation;

- Using community property income to pay expenses on separate property assets; and

- Refinancing separate property with community property funds.

Strategies to Avoid Conversion from Separate to Community Property Use of Postnuptial Agreements

Beyond basic community property agreements, comprehensive postnuptial agreements can provide additional planning flexibility. These agreements might:

- Partition certain business interests as separate property to facilitate independent management.

- Create separate property carve-outs for family heirlooms or inherited assets.

- Establish protocols for maintaining separate property character during marriage.

- Define specific assets that will remain separate despite community property presumptions.

Segregating Property

Separate revocable trusts provide an excellent mechanism for maintaining separate property character while preserving flexibility. The separate revocable trust should be funded exclusively with separate property, and all income and appreciation should remain in the trust to avoid commingling.

Strategies for Couples Moving From Community Property States

Planning Opportunity: Maintaining Community Property Status

Couples departing community property jurisdictions face the opposite challenge: preserving valuable community property benefits after establishing domicile in a separate property state. Fortunately, both statutory and strategic solutions exist to maintain these advantages.

The Uniform Disposition of Community Property Rights at Death Act

Sixteen states, including Colorado and Oregon, have adopted the Uniform Disposition of Community Property Rights at Death Act (UDCPRDA). This statute provides critical protections by:

- Recognizing the community property character of assets imported from community property states;

- Preserving the double step-up in income tax basis obtained via community property;

- Creating rebuttable presumptions regarding property characterization; and

- Protecting the surviving spouse’s community property rights.

However, the UDCPRDA only addresses disposition at death – it does not govern lifetime rights regarding management, control, or creditor protection. Couples should take additional steps to fully preserve community property benefits.

Joint Community Property Trusts

A common solution involves establishing a joint revocable trust specifically designed to hold community property assets. Key provisions should include:

- Express declaration that all trust assets retain community property character;

- Choice of law provisions selecting community property state law;

- Management provisions respecting both spouses’ equal interests; and

- Distribution terms preserving the stepped-up basis advantage.

Documentation and Titling Strategies

Proper asset titling remains crucial for preserving community property character. Recommended approaches include:

- Taking title as “John and Jane Smith, as community property”;

- Including community property recitals in deeds and account applications;

- Maintaining detailed schedules of community property assets; and

- Executing periodic affirmations of community property status.

For real property, some practitioners recommend recording a memorandum of community property status in the property records, though local counsel should review this approach for potential title issues.

Segregation and Accounting

Maintaining clear segregation between community property and any separate property acquired after the move prevents commingling arguments. Couples should:

- Use dedicated accounts for community property assets.

- Maintain contemporaneous records of all transactions.

- Document the community property source of funds for new acquisitions.

Additional Considerations

While preserving or creating community property status offers substantial benefits, couples must carefully evaluate potential drawbacks and risks.

Divorce Implications

Community property may require an equal division upon divorce, limiting flexibility in property settlements. Couples in separate property states often have greater negotiating room regarding asset division. Additionally, community property states may apply different rules regarding:

- Characterization of business appreciation during marriage;

- Treatment of professional practices and licenses;

- Spousal support calculations; and

- Tracing and reimbursement claims.

Unintended Conversion Risks

I.R.S. Rev. Rul. 68-80 demonstrates how easily community property can be inadvertently converted. The ruling involved spouses who moved from New Mexico to Virginia and “traded” their community property real estate for Virginia property, taking title as tenants in common. The IRS ruled this destroyed the community property character, eliminating the double step-up benefit.

Similar risks arise from:

- Retitling assets as joint tenants with survivorship rights.

- Converting community property to partnership interests.

- Exchanging community property for annuities or life insurance.

- Establishing certain trust structures without proper provisions.

State Law Variations

Significant differences exist among community property jurisdictions regarding:

- Income from separate property (community in some states, separate in others);

- Management rights over community property;

- Presumptions regarding property character; and

- Requirements for transmutation agreements.

These variations complicate planning for couples with connections to multiple community property states or those considering future relocations.

Creditor Protection Differences

Depending on applicable state law, community property may expose both spouses’ interests to either spouse’s creditors, while separate property may offer better protection. Or, in other states, community property designations may better protect community assets by preventing a particular spouse’s creditors from obtaining access to the community funds.

This blog was drafted by Samuel M. DiPietro, an attorney in the Spencer Fane Phoenix, Arizona, office. For more information, visit www.spencerfane.com.

Click here to subscribe to Spencer Fane communications to ensure you receive timely updates like this directly in your inbox.